The Fee Collection Detailed Report shows student-wise or receipt-wise collection details within a selected date range. It excludes receipts generated due to fee reallocations.

Steps to Access the Report:

- Go to Finance > Fee > Fee Reports

- Click on (1.5) Fee Collection Detailed Report

Filter Exaplaination :

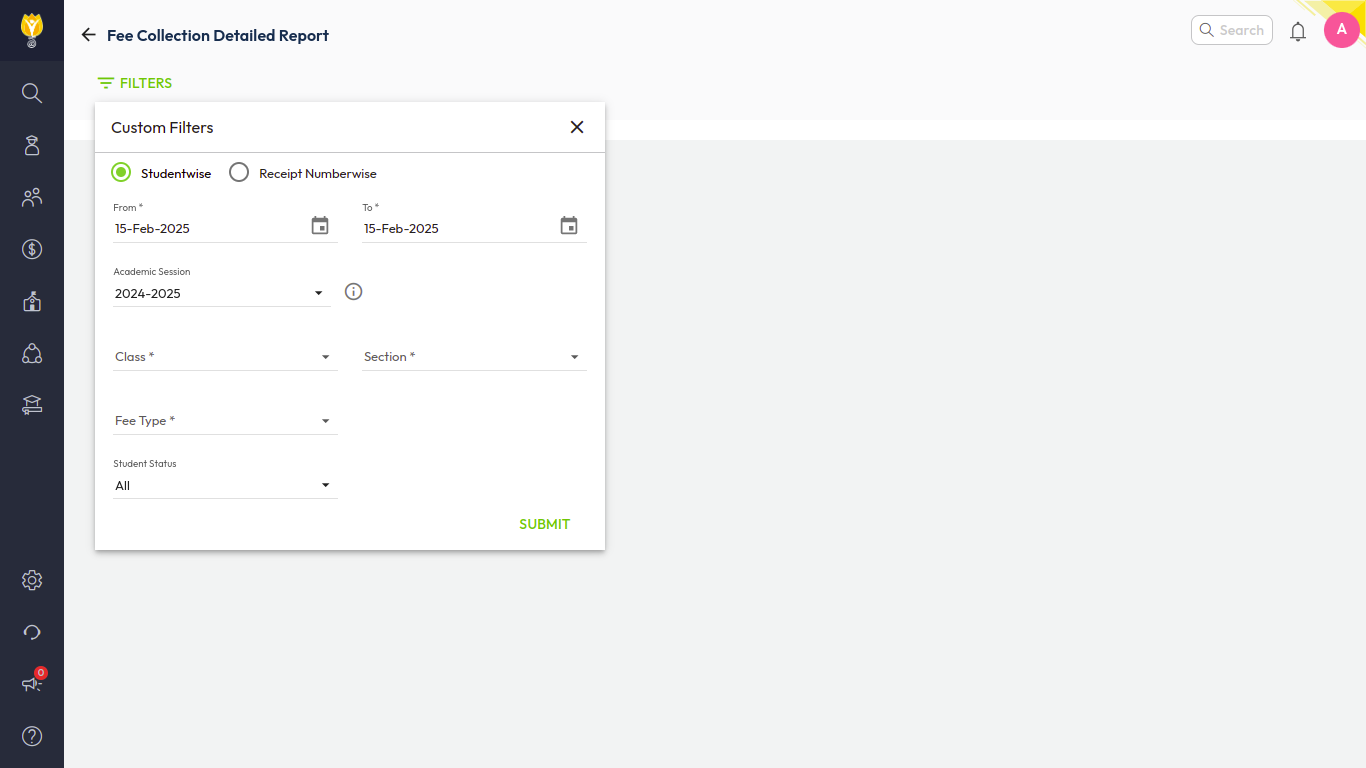

Click on the FILTERS button and choose:

- Report Format :

- Student-wise : Displays the report sorted by student names, along with all related receipts and fee amount information.

- Receipt Number-wise : Sorts the report by receipt numbers and includes a few additional filter options compared to the student-wise format.

- Day Wise & Monthly : Choose how you want to select collection timeframe.

- Payment Modes : Choice to select the specific mode of payments or all.

- Installment : Generate the report for a particular installment or all at once.

- Fee Category : View the report fee category-wise.

- Include Concession : Adds a separate column to show the concession amount given to students.

- Common Filters :

- Date Range : Choose the required time frame to pull the fee information data.

- Academic Session : Select the session to view data for that academic year duration.

- Class-Section : Choose a specific class-section or select all.

- Fee Type : Choose this if you wish to see a fee-type-wise breakup.

- Student Status : Select the status from – Active, Inactive(If student has left), or Both using the drop-down menu.

- Click SUBMIT to generate the report.

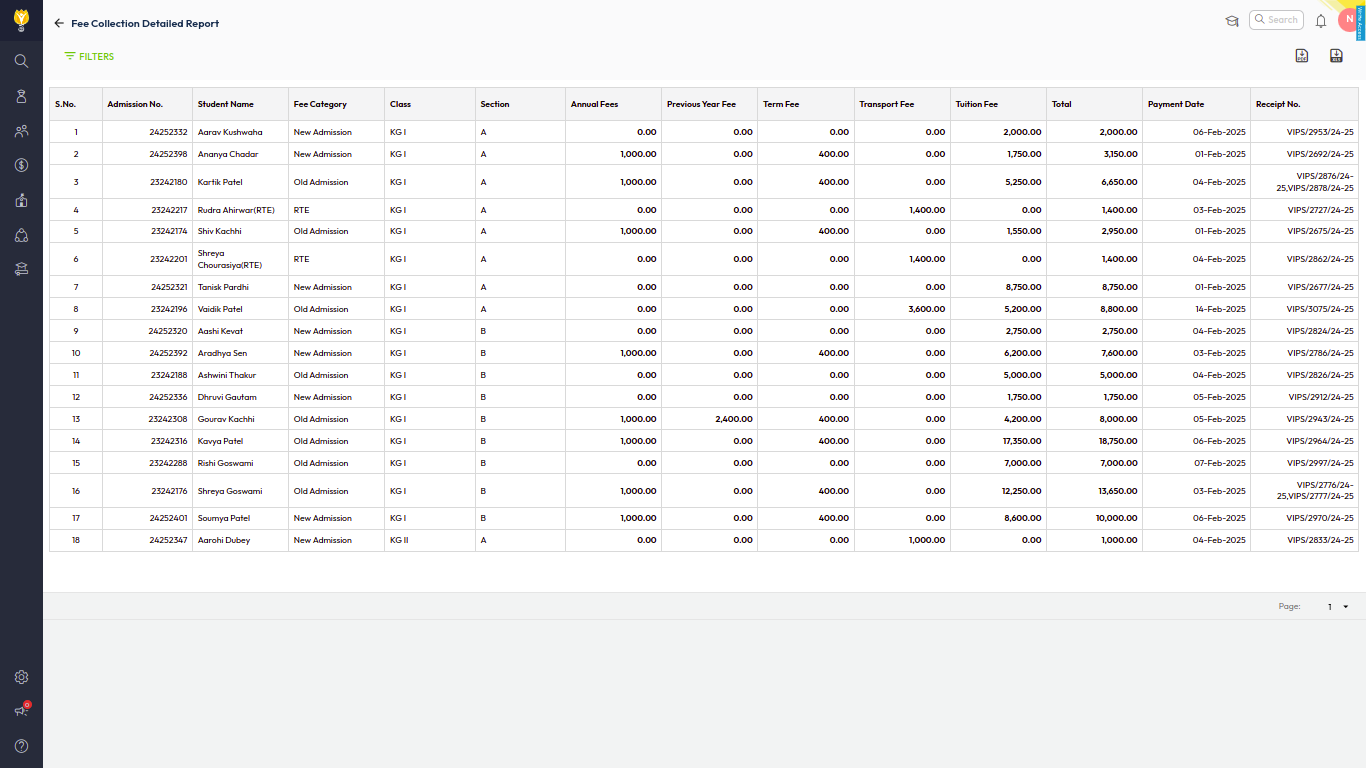

Studentwise Report

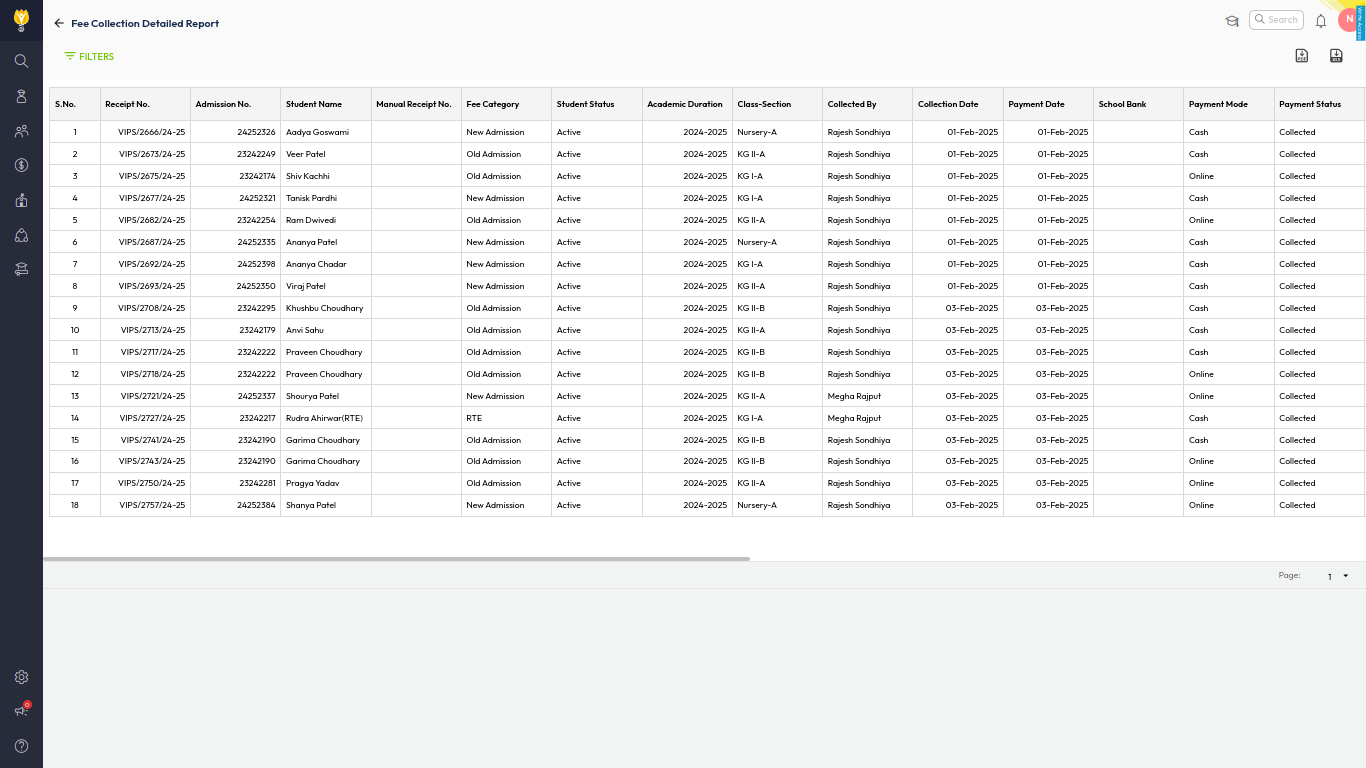

Receipt Numberwise Report

Downloading the Report:

Click the icons to download:

for Excel

for Excel for PDF format

for PDF format

The report will be saved to your device.

How It’s useful for Accountants:

- Tracks collections accurately, student-wise or receipt-wise.

- Provides details of all received payments against each student.

- Helps reconcile fee records with bank statements.

- Assists in comparing received amounts with pending dues.

- Enables easy tracking of fines and concessions.

- Excludes reallocation entries to reflect actual cash flow.

- Supports financial planning and informed decision-making.

Was this article helpful to you?

Yes2

No0